Carlos Slim Helu Book Recommendations

A prominent Mexican businessman and engineer, Carlos Slim Helu has significant holdings in telecommunications, construction, and other sectors through his conglomerate, Grupo Carso. He has been consistently ranked among the wealthiest people in the world. Slim's business acumen and philanthropic endeavors have made him a significant figure in Latin America.

An aging Spanish nobleman, inspired by tales of chivalry, becomes the errant knight Don Quixote. Accompanied by his loyal squire Sancho Panza, he embarks on absurd and touching adventures, battling windmills and chasing idealistic dreams. Don Quixote is a rich, satirical masterpiece that examines reality versus illusion, the power of literature, and the enduring human desire to find meaning and purpose—even when the world calls it madness.

In Books I–III of The Wealth of Nations, Adam Smith lays the foundation of classical economics by exploring the nature of labor, productivity, and market systems. He introduces the concept of the "invisible hand" and argues that individual self-interest can promote the public good through free-market mechanisms. Book I focuses on the division of labor and value, Book II on capital and stock, and Book III on the historical evolution of economic systems. Smith’s analysis of productivity, competition, and the role of self-regulation revolutionized economic thought and established key principles that underpin modern capitalism and economic theory.

Books IV–V of The Wealth of Nations critique existing economic policies and propose a framework for limited but essential government intervention. In Book IV, Smith dissects the mercantile system, rejecting trade restrictions and monopolies while advocating for free trade. He critiques colonialism and tariffs, favoring open markets. Book V addresses the role of the state in education, justice, defense, and infrastructure—functions Smith sees as necessary for a stable, prosperous society. These volumes balance his case for laissez-faire economics with the need for public investment, rounding out his vision of a functional, ethical, and productive political economy.

First published in 1949, The Intelligent Investor by Benjamin Graham is a foundational text on value investing and long-term financial strategy. Graham, known as the father of value investing, teaches readers how to analyze stocks with a focus on intrinsic value, margin of safety, and disciplined decision-making. The book distinguishes between “investing” and “speculating,” urging caution, patience, and rational thinking. With commentary by Jason Zweig in modern editions, the book remains a timeless guide for both novice and experienced investors. Its core message—that emotional control and sound principles are key to investment success—has influenced generations, including Warren Buffett.

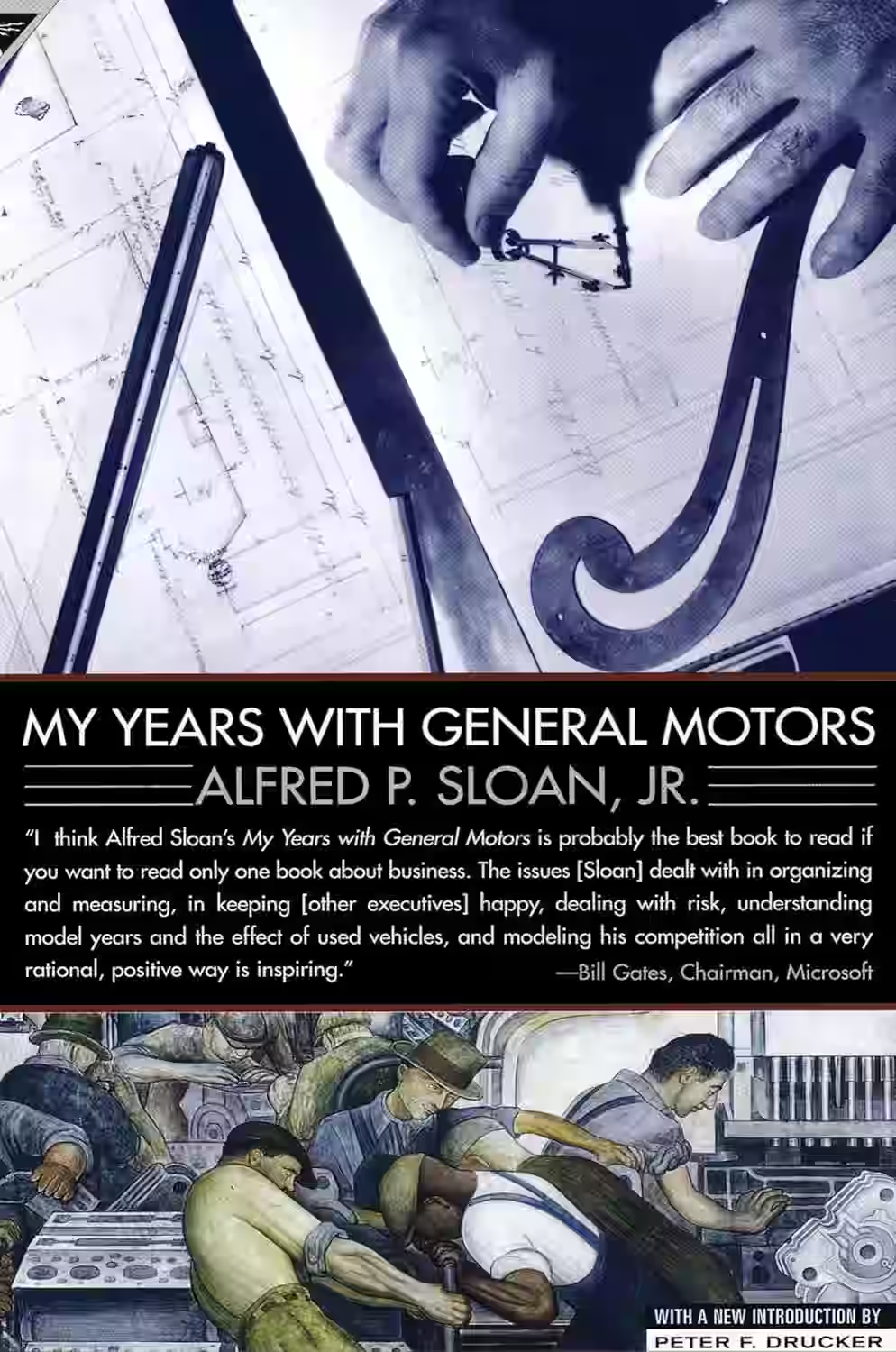

In My Years with General Motors, Alfred P. Sloan recounts his leadership of one of America’s most iconic corporations during its rise to industry dominance. Serving as GM’s president, then chairman, Sloan details how he transformed the company through decentralized management, financial discipline, and strategic innovation. His memoir provides deep insight into corporate governance, organizational structure, and long-term planning. More than a personal narrative, the book is a blueprint for modern business practices and executive leadership. It has been widely studied by business schools and executives, offering timeless lessons on scale, efficiency, and adapting to change in a competitive marketplace.